child tax credit 2022 qualifications

Frequently asked questions about the Tax Year 2021Filing Season 2022 Child Tax Credit. Ad Free tax filing for simple and complex returns.

Child Care Tax Credit Is Bigger This Year How To Claim Up To 16 000 Cnet

Married couples with income under 400000 Families with a single parent also.

. You can qualify for the credit if your dependent meets the above requirements and your annual income does not exceed. 10 hours agoChild Tax Credit Changes. If you install your photovoltaic system before 2032 the federal tax credit is.

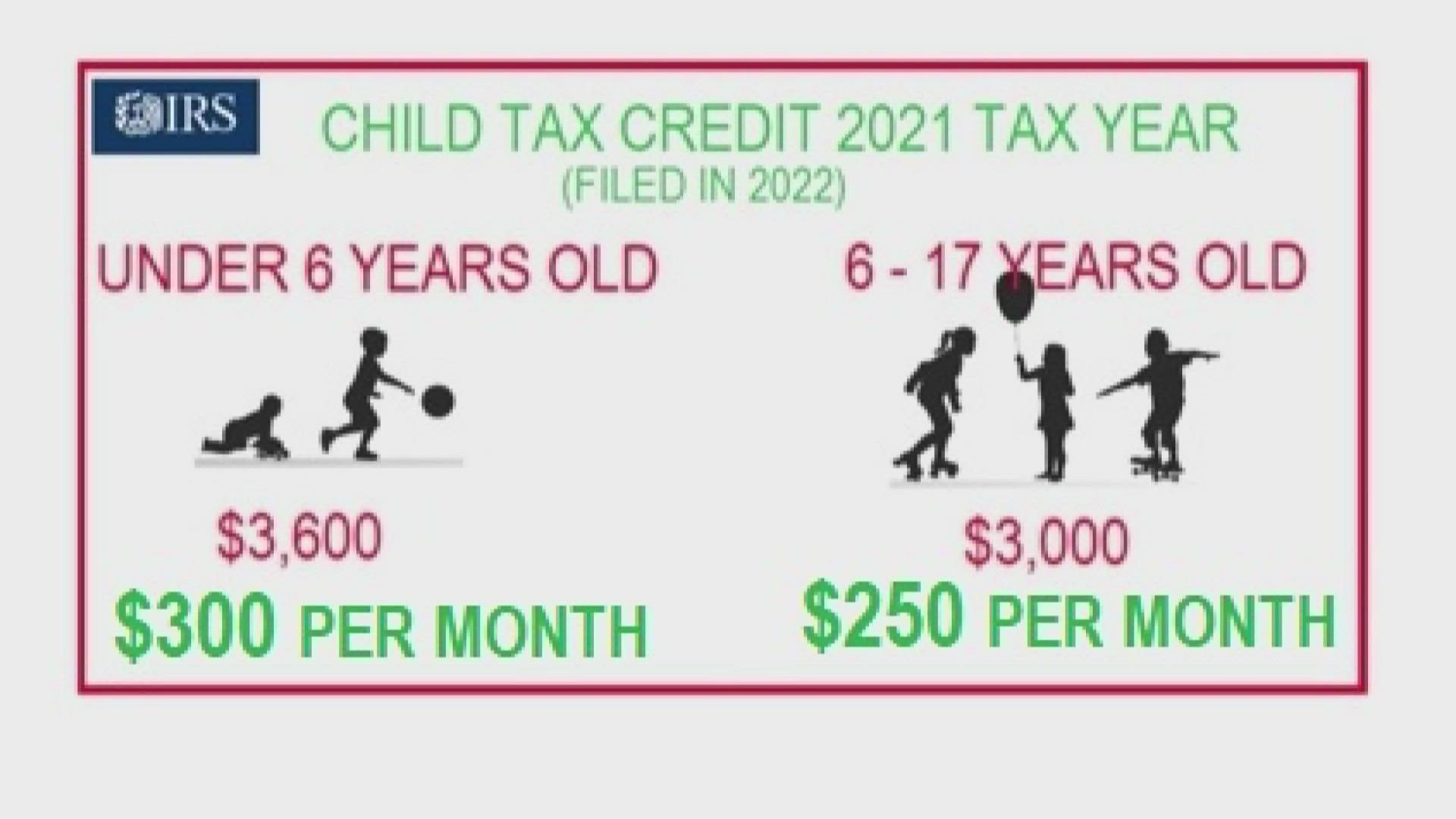

The recipient was only getting an amount of 1400 per child. These people qualify for at least 2000 of Child Tax Credit which comes out to 166 per child each month. Free means free and IRS e-file is included.

Interested applicants should contact the agency or contact person listed below for specific. Learn More at AARP. There was a partial refundability in child Tax Credit till 2020.

Ad Get the most out of your income tax refund. Guaranteed maximum tax refund. Man receives a tax refund check from the government.

In 2021 parents and. These FAQs were released to the public in Fact Sheet 2022-28PDF April 27. This service allows you to pay your State of Wyoming Child Support Payments electronically and is a service of Value Payments Systems.

Married couples filing a joint return with. Max refund is guaranteed and 100 accurate. 150000 married filing jointly or qualifying widow or.

In 2022 you can qualify for the full 2000 child tax credit if your MAGI is below 200000 for single filers or 400000 for joint filers. 6 Often Overlooked Tax Breaks You Dont Want to Miss. People who are eligible for a partial amount of Child Tax Credit.

If the amount of the credit exceeded the tax that was owed the. Another added stipulation makes it slightly harder to qualify for this years Child Tax Credit you must have earned at least 2500 in income on. Without further extensions the Child Tax Credit CTC will return to normal levels in 2022 and can be claimed when filing your tax return next year.

9 million families are entitled to up to 10000 in checks from the IRS they never claimed. If your refund is less than 1000 you. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

The child tax credit CTC will. From paying or receiving support to order modifications to establishing paternity and more we can help. In 2020 eligible taxpayers could claim a tax credit of 2000 per qualifying dependent child under age 17.

The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for qualifying children under the age of 6 and to 3000 per child. Further to get the benefit the taxable person should. The federal solar investment tax credit will have the biggest impact on the cost you will face to go solar in Wyoming.

They can be forced to pay federal or state income taxes. These people qualify for a 2021 Child Tax Credit of at least 2000 per qualifying child. Get Help maximize your income tax credit so you keep more of your hard earned money.

After those thresholds the credit. The child tax credits remaining balance may be taken from you if you are due a tax return in 2022. The IRS deadline for the 2022 tax year is April 18 2022 you can file for the child tax credit when you submit your income tax return.

This year that difference is capped at 1500. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. All payments are charged to your account.

The State of Wyoming currently has three property tax reliefcreditdeferral programs available. With our many time and money-saving services as well as expert and caring staff the. The Child Tax Credit was only partially refundable prior to 2021 with this being up to 1400 per qualifying child and you needed at least 2500 of earned income to qualify for.

Child Tax Credit For 2022. The Additional Child Tax Credit or ACTC is a refundable credit that you may receive if your Child Tax Credit is greater than the total amount of income taxes you owe as long as you had an.

Feds Launch Website For Claiming Part 2 Of Child Tax Credit

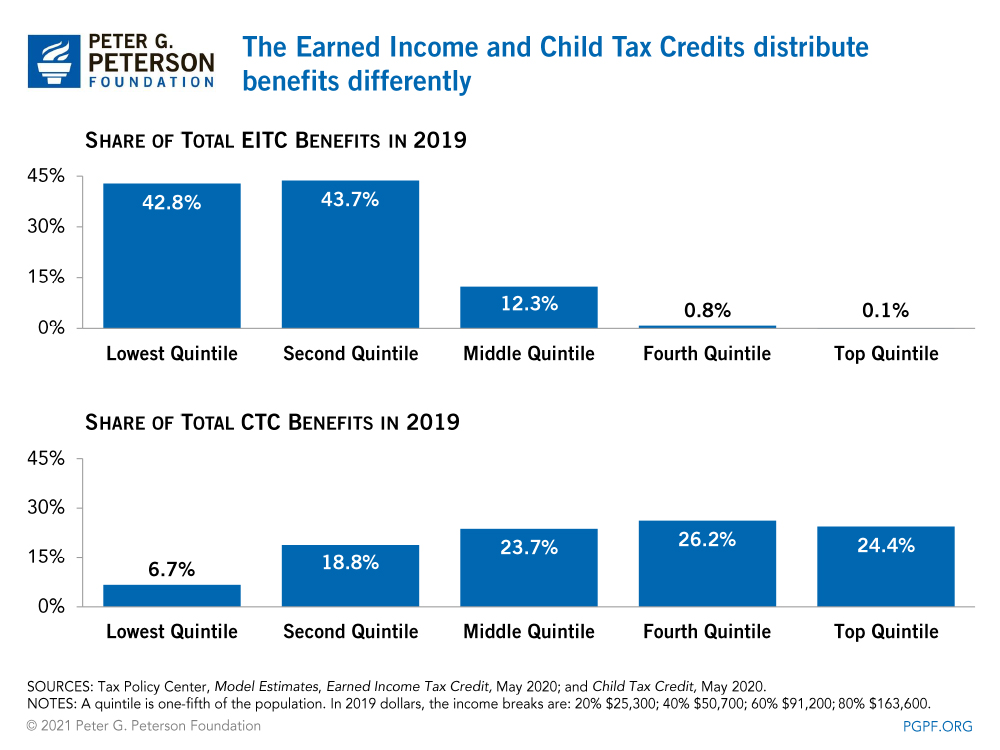

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Child Tax Credit Faqs For Your 2021 Tax Return Kiplinger

What Is The Child Tax Credit Tax Policy Center

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Child Tax Credit 2022 Who Is Still Eligible For Child Payments Marca

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Child Tax Credit Did Not Come Today Issue Delaying Some Payments Kare11 Com

How The 3 000 Child Tax Credit Could Affect Your Tax Bill

Expanded Child Tax Credit Available Only Through The End Of 2022 Cbs Los Angeles

Democrats Further Effort To Expand Child Tax Credit For Pandemic Relief

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979823/bigbill.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Irs Launches Website For Claiming Part 2 Of Child Tax Credit Kgan

Child Tax Credit 2022 Everything You Need To Know Walletgenius

Child Tax Credit Including How The 2021 Relief Bill Changed It Wsj

The Child Tax Credit Grows Up To Lift Millions Of Children Out Of Poverty Tax Policy Center